Car insurance mistakes that could invalidate your claim

When it comes to car insurance, people rarely take the time to read the fine print before purchasing a policy – the reality is though, there are dozens of mistakes drivers make that can ultimately end up invalidating their policy and ruining their claim.

Here are some of the most common car insurance mistakes that could end up invalidating your claim:

Lying on your application

Lying on your application is a form of insurance fraud and will invalidate your policy, so don’t be tempted to fudge the details. Be honest about your driving history, personal details, annual mileage and home address, even if you’re concerned some details may cause your premium to rise. A higher premium is nothing compared to footing a bill for an accident repair.

Making vehicle modifications

Features added to your car after manufacture are considered modifications and need to be declared. Some drivers are caught short because they forget or simply don’t realise; if you make modifications like new stereo system or alloy wheels be sure to inform your insurer so they can update your policy.

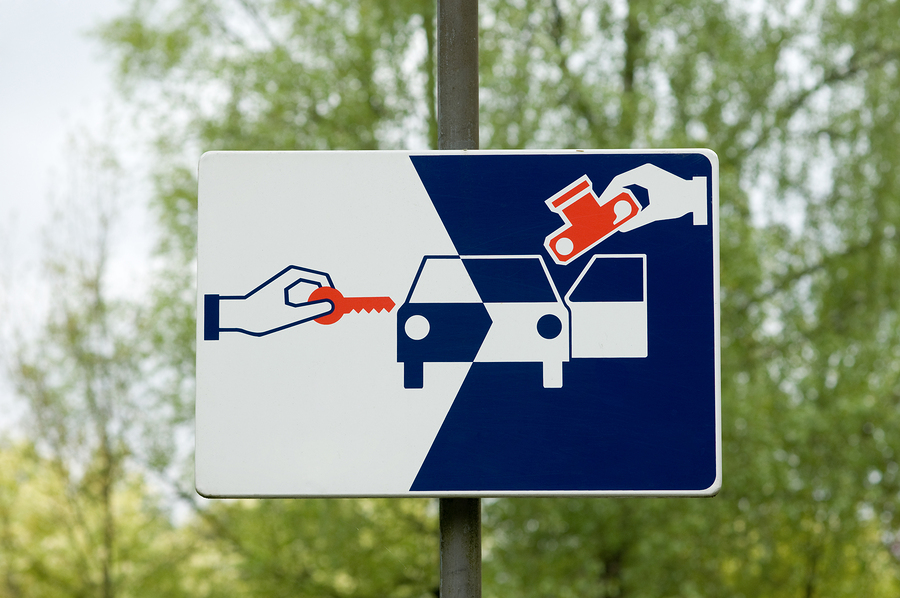

Being vulnerable to theft

Most comprehensive car insurance policies cover you for theft of your vehicle or items stolen inside it – as long as driver negligence isn’t to blame. Valuables should be put in the boot out of plain sight and your car should never be left unlocked or with the keys in the ignition, even if you’re just popping into a garage or warming your car in the drive on a cold morning.

Going over your mileage

As part of your application your insurer will ask you to give a rough estimation of how often you drive. Certain policies will have a mileage limit as a way of keeping your premium low. If your driving habits change – for example if your commute changes for a new job – and your mileage is noticeably increasing, be sure to inform your insurer of the change.

Driving without an MOT

The annual MOT test might feel just another thing you need to pay for, but it’s important for more reasons than one. In addition to ensuring your car is safe and roadworthy, it’s important to get your MOT done on time – many insurers will invalidate your cover if you’re driving without one.

Disclaimer

The contents of this article are for reference purposes only and do not constitute financial or legal advice. Independent financial or legal advice should be sought in relation to any specific matter. Articles are published by us without any knowledge or notice of the circumstances in which you or anyone else may use or rely on articles or any copy of the information, guidance or documents obtained from articles. We operate and publish articles without undertaking or accepting any duty of care or responsibility for articles or their contents, services or facilities. You undertake to rely on them entirely at your own risk, and without recourse to us. No assurance of the quality of articles is given or undertaken (whether as to accuracy, completeness, fitness for any purpose, conformance to any description or sample, or otherwise), or as to the timeliness of the publication.