A New Year’s resolution which could last a lifetime

It’s February. We’ve put January and Blue Monday behind us and now it’s time to look to the future.

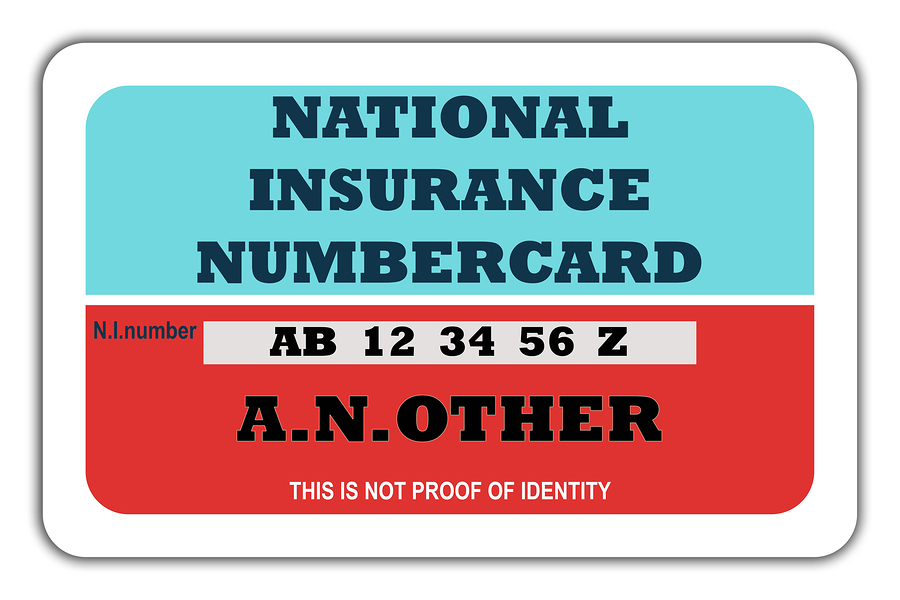

This is the time of the year when many people make New Year’s resolutions and as it’s a month for tax returns, our thoughts are turning to resolutions about personal finances. The team at Silversurfers.com realised that one area which many of us forget about is our State Pension, and the ways we could potentially improve it. Your State Pension is based on your National Insurance (NI) record, and if you are unable to work (or you don’t earn enough to pay, or be treated as paying NI contributions) you may be able to apply for credits which could help you fill in any gaps in your NI record and possibly increase the amount of State Pension you could get.

It only takes a moment to check both your State Pension and review your NI record online at the same place, at the same time. We’ve pulled together a quick guide to help you find out if there are some credits you could apply for. So make checking your State Pension a New Year’s resolution! And we hope that you will share this with friends and family so they can get to know their State Pension too. You will need to register to use the online service, if you haven’t already and have your identity confirmed.

Your National Insurance record is very important!

Many people don’t realise how important it is to know where you stand with your National Insurance (NI) record. Your State Pension is based on your NI record, and it may be that if you have gaps in your record, it could affect the amount of State Pension you get. If this sounds a bit confusing, then read on and we’ll try to make this a bit more understandable.

So let’s start with the new State Pension. If you have 10 qualifying years of NI contributions on your record when you reach State Pension age you should qualify for some State Pension. Many people have times in their lives when they haven’t paid NI, so an online government service is available where you can check how many years you have on your NI record and see if you have any gaps. All you have to do is click here to check your State Pension online and follow some simple steps. The check your State Pension service can be a real help. It will confirm the exact date at which you can get your State Pension and give you a forecast of how much it might be by this point if you continue to contribute to it during the future years available to you – which will help you better plan your retirement.

If you have gaps in your NI record, or are not working at the moment, there may be things you can do to improve your record and increase your State Pension.

Caring for an adult

Many of you will be looking after sick or elderly family or friends and may be eligible for Carers Credit – which is a National Insurance credit that helps fill gaps in your NI record for the times you were caring for someone. As we’ve said, your State Pension is based on your NI record and it’s important to make sure that your NI record is up to date. This credit means you can be a carer and still gain qualifying years that count towards your State Pension.

The criteria for qualifying for Carers Credit apply to you and the person you are looking after.

You must be caring for one person, or more than one person, for at least 20 hours a week. You must also be aged 16 or over but under State Pension age.

The person you look after must get:

- A qualifying benefit, or

- Be certified by a health or social care professional as needing the amount of care being provided.

You don’t need to apply for Carers Credit if you’re getting Carers Allowance as you’ll automatically get credits.

Click here to see more information on Carers Credit and how to apply for it.

Caring for a child

If you help out with looking after grandchildren (or any other relatives under 12), you might be able to apply for specified adult childcare credits. You can apply for credits as far back as April 2011.

Parents and carers in receipt of child benefit automatically get a credit that fills the gap in their NI record, and counts towards their State Pension. This credit can be transferred from a parent / carer, provided they do not need the credit for themselves, to another relative if that family member helps out with childcare.

For more information visit the website here

Forces Spouses

If you have accompanied a spouse or civil partner on a posting overseas in the last few years because they are in the Forces, you might have been unable to work and pay NI contributions whilst abroad. This may mean that you have gaps in your National Insurance contributions record which could affect your future State Pension. You may be able to fill these gaps with National Insurance credits.

For more information, visit the gov.uk website

…And whilst we’re talking about marriage, have a think about marriage allowanceThe Marriage Allowance reduces your tax by up to £220 a year and you can apply if you are married or in a civil partnership. If you haven’t claimed yet you may be able to claim for two years and you could save up to £432.

Here is a handy calculator you can use to see how much tax you could save

And this is where you can see more information and apply for the Marriage Allowance.

Other ways to fill in the gaps

If, after you have checked your State Pension forecast, you find that you aren’t eligible for credits you could consider paying Voluntary NI contributions. Essentially, you would fill in the gaps of your NI record by paying extra NI contributions. However, these need to be paid within set time limits and you should think carefully about whether paying voluntary NI contributions if the right option for you. If, for example, you are continue to work or get certain benefits, further qualifying years may be added to your NI record before your reach State Pension age and so you may not need to pay voluntary NI contributions – they will not always improve an individual’s State pension. But Check your State Pension will help you understand whether paying to fill the gaps in your NI record will improve your State Pension forecast.

There is online information and advice here

If you’re still confused, a good place to start is www.gov.uk/yourstatepension

Latest posts by Sally - Silversurfer's Editor (see all)

- How to spot likely scammers on social media - February 13, 2025

- Romantic Valentine’s Menu to Enjoy at Home - February 13, 2025

- Geeta’s Caramelised Onion, Mango & Ginger & Goat’s Cheese Tart - February 11, 2025

- Would you support compulsory digital ID cards? - February 11, 2025

- Do you support the proposed amendment to the assisted dying Bill? - February 11, 2025