Pensioner P60 plea to simplify tax

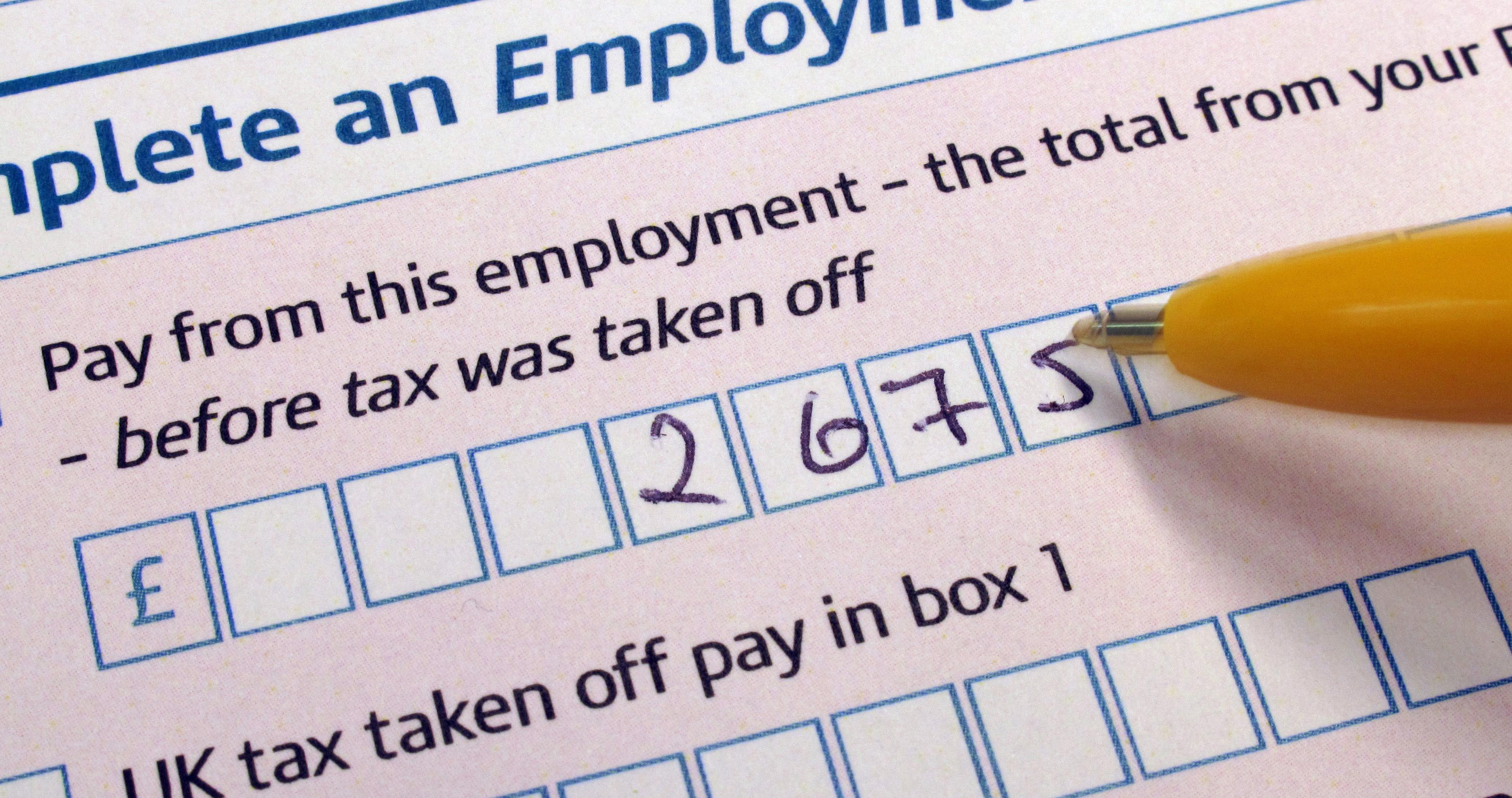

Pensioners should receive P60-style annual statements as part of moves to make the tax system fairer and easier to understand, an independent advisory body has recommended.

The form – called a DWP60 – would be issued by the Department for Work and Pensions, setting out the amount of taxable income received from the state pension and social security benefits in the tax year, the Office of Tax Simplification (OTS) said.

It would parallel the P60 that employers and pension providers give out and would ensure that pensioners know exactly what taxable income they are receiving, the OTS said.

The body’s recommendations have been put to the Treasury for consideration and follow an 18-month review during which the OTS gauged the views of pensioner groups.

The OTS also said that banks and building societies should ask annually if the tax status of a savings account is correct and ensure account holders have necessary guidance on tax on interest.

John Whiting, tax director of the OTS, said: “Pensioners have told us many times how the tax system gets more complex as they get older.

“We have to work within our brief to be revenue-neutral, but we think our recommendations could make a real difference in stripping away complexities and giving pensioners information that will help understanding and make it easier for them to deal with their obligations.”

The Low Incomes Tax Reform Group (LITRG) welcomed the recommendations, which come at a time when landmark changes to pension saving are taking place as up to nine million people are automatically enrolled into workplace pension schemes.

The Government recently outlined its plans for a new “single tier” state pension to bring more simplification to retirement planning.

The LITRG’s chairman, Anthony Thomas, said: “Pensioners on low incomes need far more support than they are currently getting to navigate what has become a highly complex tax system. In this report, the OTS has produced some well thought-out recommendations which should simplify the tax system for many pensioners. We welcome the recommendation of a DWP60.”

Latest posts by Sally - Silversurfer's Editor (see all)

- Freezing this Christmas, a charity single could hit the number one spot - December 20, 2024

- Theatre tickets from £10 for 50+ London shows with See It Live in 2025 - December 19, 2024

- Should Waspi women be entitled to compensation? - December 17, 2024

- What was your favourite childhood toy? - December 17, 2024

- It’s never too late to play bridge - December 15, 2024