Home owners downsize ‘to cut bills’

A third of home owners who plan to downsize in the near future are doing so in order to cut their household bills, a study has found.

Just over half (51%) of home owners surveyed who are planning to move in the next three years said they plan to downsize, compared with just over a fifth (22%) who are looking to trade up to somewhere bigger, Lloyds TSB found.

But “empty nesters” who no longer need the space are not the only ones looking to trade down, and while 63% of those looking to do so are aged over 55, more than a quarter are aged between 46 and 55, and about 5% are aged between 36 and 45, the study found.

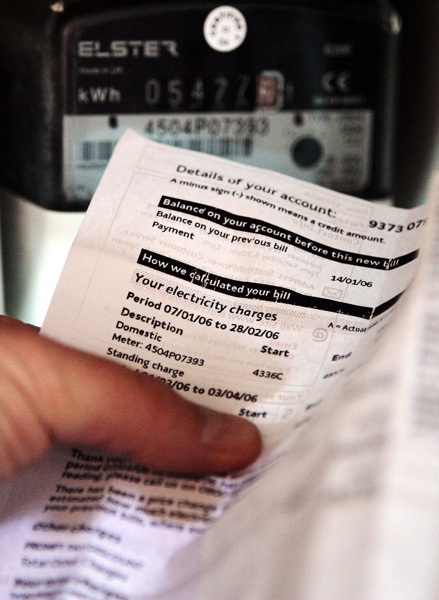

Money worries have strongly influenced people’s plans to downsize, with 33% of potential downsizers saying they need to move to reduce their household bills and 37% saying they would like to free up some equity. Three in 10 of those planning to trade down said they were doing so to boost their retirement income.

Households have been squeezed by high living costs at a time when they are seeing low wage increases and struggling to make real returns on their savings amid low interest rates.

Mortgage lenders have tightened their borrowing criteria in recent months, which could also make it harder for home owners to progress up the housing ladder.

Trading down from a detached home to a bungalow could produce an average windfall of just over £97,000 across the UK, a 41% increase on the £68,814 average sum which could have gained in 2002, researchers found.

Londoners could receive the highest average sum by trading down, at around £269,415, while people in Yorkshire and Humberside have seen the biggest 10-year percentage increase in their average windfalls out of the regions, with an 84% rise.

Stephen Noakes, mortgage director for Lloyds TSB, said: “Downsizers are now playing a key role in the housing market and, as the study shows, we are starting to see home owners on different stages of the property ladder considering it a sensible option as more and more families are looking at ways to save money.”

Has your nest emptied yet?

Latest posts by Sally - Silversurfer's Editor (see all)

- Freezing this Christmas, a charity single could hit the number one spot - December 20, 2024

- Theatre tickets from £10 for 50+ London shows with See It Live in 2025 - December 19, 2024

- Should Waspi women be entitled to compensation? - December 17, 2024

- What was your favourite childhood toy? - December 17, 2024

- It’s never too late to play bridge - December 15, 2024